Forestry in the Baltics and the UK has historically given a stable and robust risk-adjusted return based on biological and sustainable growth with an element of inflation hedge and diversification through low return correlations with the stock market. The demand for wood is increasing as wood is gradually becoming a substitute for concrete, steel and plastic in a world with increased focus on our carbon footprint and the environment.

Sustainable & Robust Investments

WITHIN FORESTRY & LAND

Cresco capital

Sustainable & Robust Investments

VALUE CREATING BIOLOGICAL GROWTH

A significant part of value creation comes from the biological growth, which every year adds volume to the condition of the trees and increases the diameter of the individual tree in the stand. When entering a partnership with Cresco Capital Services, we carefully examine and calculate the expected financial return of the forest based on relevant growth models and market knowledge about wood prices. Regardless of fluctuations in the stock market, forests and wood prices, forests each year typically add between 4 % and 11% in value due to the recurring biological growth.

LOW CORRELATION WITH THE STOCK MARKET

The recurring annual biological growth combined with the flexibility of when to sell and harvest timber provides a very low correlation with the stock market. This is a very attractive characteristic for many investors with a diversified portfolio of investments. A portfolio of forests with a mixture of tree species such as spruce, pine, birch and other deciduous trees, which are resilient at different ages, provides a high degree of flexibility to create a stable cashflow despite turbulent economic periods.

INCREASING DEMAND FOR WOOD AS A RAW MATERIAL

There is great innovation within the wood industry locally, regionally and globally, and new innovative products are being developed and commercialized, increasing the demand for timber. It is gradually becoming a substitute for concrete, steel and plastic. As a result of the Nordic and European ambitions to achieve the energy and climate goals of 2030 and 2050, the demand for wood is expected to increase even further.

EFFICIENT RISK MITIGATION

By investing in a geographically dispersed portfolio of forests, the risk of fire damage, wind blowing, and insect and fungal diseases is efficiently mitigated. By certifying forests either by PEFC or FSC, it is objectively documented that the forests are sustainably managed, which for example often ensures higher prices for timber and a larger market for the products. A portfolio of forests consisting of different species and a mix of different ages, ensures a robust and positive cash flow from the forest investment to cover fixed costs from administration and eventually leverage.

Cresco capital

Knowledge and experience

Cresco Capital Services has more than 30 years of experience in investment and asset management within forestry, land, real estate and natural resources.

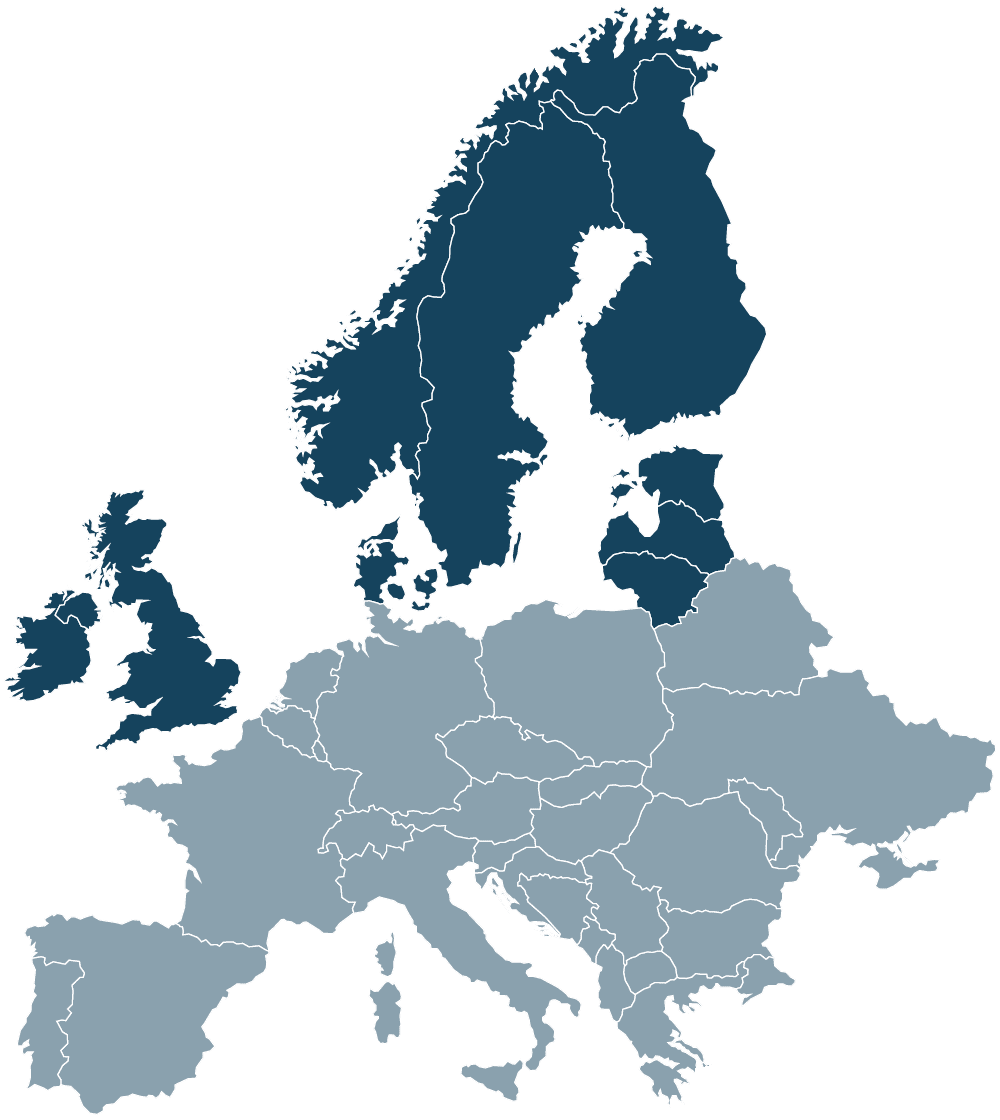

Northern Europe

Cresco Capital Services is headquartered in Denmark and has extensive knowledge and experience in forestry in Northern Europe. We focus on sustainable investments and management of land and forestry assets in the UK, Ireland, The Nordic Countries and in the Baltics.